are raffle tickets tax deductible if you don't win

Enter the total of your deductible losses on line 28 of the Schedule A. For example if raffle tickets are 50 and the prize is a 20000 car greater than 50 x 300 then the organization would have to report the winnings to the IRS on a W-2 G.

How To Run A Nonprofit Sweepstakes Everything You Need To Know Official Rules Center

So can I deduct the money for the tickets as a.

. If you buy 20. File Your Taxes Today. Per IRS pub 526 page 6 If you receive or expect to receive a financial or economic benefit as a result of making a contribution to a qualified organization.

As I understand the taxes the first prize win is much less than the 300. The IRS considers a raffle ticket to be a. Dear Tax Talk A nonprofit lets call it X has a raffle with 125 tickets and a 5000 first prize.

Whether a car boat or house is at stake mega-prizes driving raffle ticket sales come with tax liability for their fair market value. For example if you bought 100 worth of raffle tickets that did not win but won 500 on a 5 raffle ticket you would have to claim 500 in income but. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Deduct only the amount of losses equal to your winnings if your winnings exceeded your losses. Not every section allows these deductions. Only do a charity raffle if you want to potentially win cool prizes but feel OK receiving nothing in return remember 19 in 20 people win nothing.

If you receive or expect to receive a financial or economic benefit as a result of making a. Gambling professionals who earn a profit may qualify for the pass-through tax deduction established by the Tax Cuts and Jobs Act. Tax on winnings should be reported to you in Box 1 reportable winnings of IRS Form W-2G.

So for instance if you make 42000 annually and file as single your federal tax rate is 22. Significantly under-reporting a raffle prize could raise a red flag with the IRS and cause your return to be audited. Essentially if you want a tax deduction dont do a charity raffle.

I did not win the item or anything. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. If you win 1000 your total income is 43000 and your tax rate is still 22.

Per irs pub 526 page 6. One way to write off your raffle ticket is as a gambling loss. If you are found to owe more tax youll owe penalties and interest on top of that.

Per IRS regulations raffle. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. It may seem like a dirty trick but you will have to pay income taxes on the fair market value of the car minus the cost of the raffle ticketwhether you sell the car or not.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. As such a raffle generally. Easy Software To Help You Find All the Tax Deductions You Deserve.

I bought raffle tickets from a nonprofit organization for a chance to win an item. Some raffle sponsors are beginning to mitigate these when. Your lottery ticket deduction is always limited to the amount of gambling income reported on your return.

Reporting Raffle Prizes Raffle Defined. For example suppose you. No you cannot.

Maximum Gambling Loss Deduction. If you win a charity. 16 hours agoBy submitting an entry each purchaser acknowledges having read and agreeing to abide by the North Fork Valley Public Radios Official Raffle Rules.

Raffle sponsors keep tickets. The purchase of a raffle ticket is not tax-deductible. Religious and charitable organizations typically fall under section 501 c 3 and can receive tax-deductible donations.

Its a fun different and potentially exciting way to donate to. Also be required to withhold and remit federal income taxes on prizes. In general a raffle is considered a form of lottery.

This deduction permits business owners.

Are Nonprofit Raffle Ticket Donations Tax Deductible

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Tax Brilliance Accounting Strategies Tax Planning And Financial Coaching Home Facebook

Are Raffle Tickets Tax Deductible The Finances Hub

Why Are Lottery Ticket Sales Considered A Regressive Tax Quora

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Your New Online Fundraising Platform Rallyup

Are Raffle Tickets Tax Deductible The Finances Hub

Are Raffle Tickets Tax Deductible The Finances Hub

Tax Brilliance Accounting Strategies Tax Planning And Financial Coaching Home Facebook

Are Raffle Tickets Tax Deductible The Finances Hub

35 Quotes That Will Help Set Your Weeks Intentions Because Im Addicted Work Quotes Inspirational Words Boss Quotes

Are Raffle Tickets Tax Deductible The Finances Hub

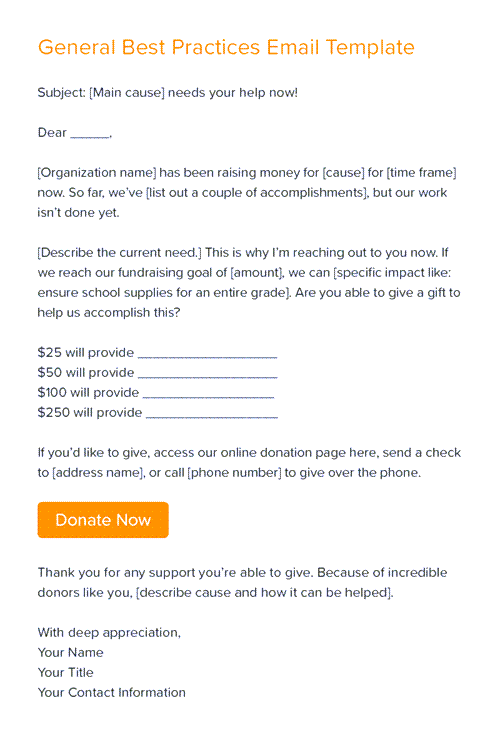

6 Amazing Tips For Asking For Donations With Emails Qgiv Blog